The Baron Tax & Accounting PDFs

The Main Principles Of Baron Tax & Accounting

Table of ContentsBaron Tax & Accounting Fundamentals ExplainedOur Baron Tax & Accounting StatementsThe 25-Second Trick For Baron Tax & AccountingSome Ideas on Baron Tax & Accounting You Need To KnowExcitement About Baron Tax & Accounting

Plus, bookkeepers are anticipated to have a good understanding of maths and have some experience in a management function. To come to be an accounting professional, you must have at least a bachelor's level or, for a greater level of authority and proficiency, you can end up being an accountant. Accounting professionals must likewise fulfill the strict demands of the accountancy code of method.

This makes certain Australian service owners obtain the best possible financial suggestions and administration possible. Throughout this blog, we have actually highlighted the big distinctions in between accountants and accountants, from training, to duties within your business.

A Biased View of Baron Tax & Accounting

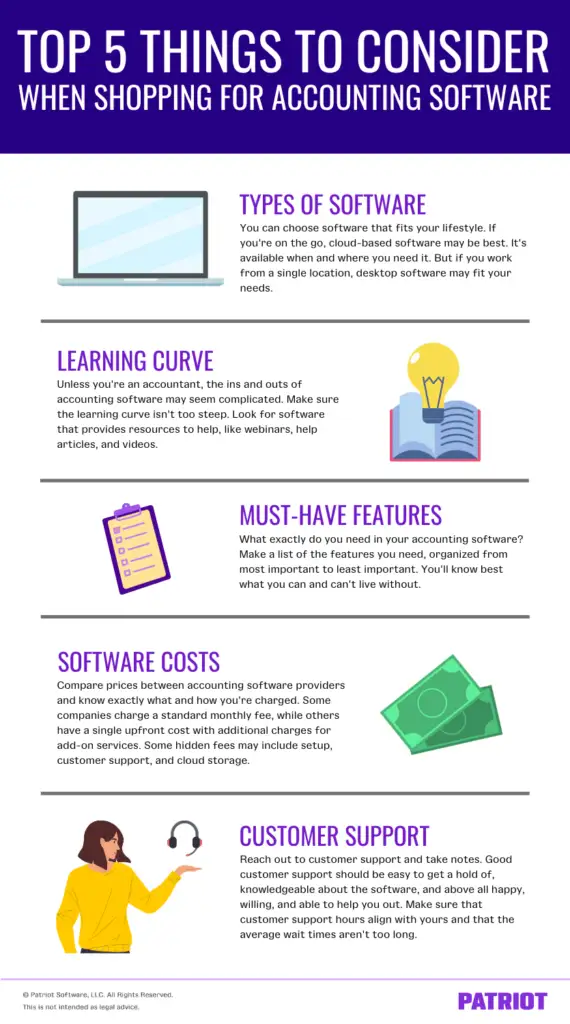

Bookkeeping firms do more than simply accounting. The solutions they offer can take full advantage of profits and sustain your financial resources. Businesses and people need to take into consideration accounting professionals a crucial element of monetary preparation. No bookkeeping company offers every solution, so ensure your experts are best suited to your details requirements (trusted online tax agent). Understanding where to start is the very first difficulty

Accounting professionals additionally can advise customers on making tax law benefit them. All taxpayers have the right to representation, according to the IRS. Accountancy companies can help services represent their interests with examination for filing procedures, info requests, and audits. The majority of companies don't work alone to accomplish these answers. They work along with lawyers, financial coordinators, and insurance policy professionals to produce a strategy to reduced taxi payments and prevent costly mistakes.

(https://pubhtml5.com/homepage/aglhq/)

Accountants are there to determine and upgrade the set amount of money every worker receives consistently. Keep in mind that vacations and sicknesses impact payroll, so it's a component of business that you need to frequently upgrade. Retirement is also a substantial component of payroll management, especially considered that not every employee will intend to be enrolled or be eligible for your business's retired life matching.

Indicators on Baron Tax & Accounting You Should Know

Some loan providers and financiers require crucial, tactical choices in between the service and shareholders complying with the conference. Accounting professionals can additionally exist below to assist in the decision-making process. Prep work involves providing the earnings, capital, and equity declarations to examine your current monetary standing and condition. It's simple to see exactly how complex bookkeeping can be by the number of skills and jobs required in the role.

Small companies often encounter distinct economic obstacles, which is where accounting professionals can give very useful assistance. Accountants offer a series of solutions that aid businesses stay on top of their finances and make educated choices. Accounting professionals likewise guarantee that organizations adhere to monetary policies, taking full advantage of tax savings and minimizing errors in economic records.

Hence, professional accounting assists prevent expensive blunders. Payroll monitoring entails the administration of employee earnings and incomes, tax deductions, and advantages. Accounting professionals guarantee that employees are paid accurately and on schedule. They determine payroll taxes, take care of withholdings, and ensure compliance with governmental regulations. Processing paychecks Taking care of tax filings and settlements Tracking fringe benefit and deductions Preparing payroll records Appropriate pay-roll administration stops issues such as late payments, wrong tax filings, and non-compliance with labor regulations.

Facts About Baron Tax & Accounting Uncovered

Tiny business owners can count on their accounting professionals to handle complicated tax obligation codes and guidelines, making the declaring procedure smoother and extra effective. Tax obligation preparation is an additional crucial service supplied by accounting professionals.

These solutions usually concentrate on company evaluation, budgeting and projecting, and cash circulation management. Accounting professionals aid small companies in determining the worth of the company. They look at this site examine assets, obligations, earnings, and market problems. Approaches like,, and are used. Precise evaluation assists with selling the company, safeguarding financings, or bring in capitalists.

Explain the procedure and solution questions. Fix any type of inconsistencies in documents. Overview organization owners on finest methods. Audit assistance aids companies experience audits smoothly and efficiently. It decreases stress and errors, seeing to it that organizations meet all necessary guidelines. Legal conformity includes sticking to laws and regulations connected to organization operations.

By setting realistic economic targets, businesses can allot resources successfully. Accountants overview in the application of these techniques to ensure they line up with the service's vision.

The Definitive Guide for Baron Tax & Accounting

They guarantee that services follow tax laws and sector laws to prevent penalties. Accounting professionals likewise suggest insurance coverage policies that supply protection versus possible threats, guaranteeing the company is secured versus unpredicted events.

These devices aid little services keep accurate records and enhance procedures. It aids with invoicing, payroll, and tax obligation prep work. It offers numerous features at no cost and is ideal for start-ups and tiny organizations.